Gold shone bright at this year’s Diggers & Dealers Mining Forum as 1,900 delegates converged in Kalgoorlie, marking its first time without visitors from overseas and interstate.

Relive the golden highlights from the 29th year of the Diggers & Dealers Mining Forum.

The Deloitte WA Index’s gold report is a tale of two decades, covering gold’s transition from Y2K to the COVID-19 pandemic and everything in between.

Discover how the same asset that was used to support various monetary systems around the globe in the 20th century remains a key element in today’s economic tapestry, with its intrinsic value and ability to weather market declines, rising inflation and depreciation of currency.

ABC Refinery is now accredited by the CME Group for its premier gold product, the COMEX ‘GC’ gold futures contract, and sees ABC Refinery bars added to the COMEX good delivery list of brands used to physically settle against the GC gold futures contract in New York.

ABC Refinery is the refining division of the Pallion Group and have been involved in the refining and processing of precious metals in Australia since 1951.

Australia’s gold exports are forecast to hit a record high of AUD $25 billion in 2019-20 according to the Department of Industry, Innovation and Science’s September edition of Resources and Energy Quarterly (REQ).

The September REQ shows Australia remains the world’s second largest producer of gold, with production increasing by 6.3% in FY 2018–19 to 321 tonnes, equating to 9% of the world’s total supply in 2018.

The Gold Industry Group joined more than 600 investors, bullion and finance industry professionals and media to learn about the global case for gold at ABC Bullion’s sold out national conference in Sydney on Tuesday 20 August.

Pallion CEO Andrew Cochineas (ABC Bullion’s parent company) kicked-off the conference noting that the Australian gold industry was a true bright light in the Australian economic landscape with a record gold price combined with the competitive advantage of a weaker Australian dollar.

This year’s Diggers & Dealers was as good as gold as 2450 delegates descended on Kalgoorlie for mining’s biggest industry event.

Former Australian Prime Minister John Howard was a hit, gold shone throughout the three day program with GIG Directors Andrea Maxey and Stuart Tonkin taking to the stage, a focus on the image of mining created much discussion at our popular breakfast event with Deloitte, and Northern Star Resources claimed dealer of the year.

With gold breaking through AUD$2,000, the outlook for gold mining equities is immense. How can gold producers take advantage of this new gold bull market?

Jake Klein, Evolution Mining Executive Chairman, will provide the answer in his keynote presentation at ABC Bullion’s National Conference 2019: A Global Case for Gold.

The Perth Mint has unveiled Australia’s greatest gold icon in New York City for a rare one day event to celebrate the official launch of The Perth Mint Physical Gold Exchange Traded Fund (NYSE Arca: AAAU) on the New York Stock Exchange.

The one-of-a-kind Australian Kangaroo One Tonne Gold Coin is recognised by Guinness World Records as the largest coin ever created. Tipping the scales at 1,000kg of 99.99% pure gold, and measuring 80cm wide and 13cm deep, this masterpiece of precious metal engineering and craftsmanship is valued at more than AUD60million

Meet Technical Coordinator Amanda Wang, as she takes us behind the scenes at ABC Refinery, from perfecting Australia’s precious metals to the latest technology.

The Perth Mint has expanded the market for Australian gold in China with its recent appointment as an International member of Shanghai Gold Exchange (SGE).

As an International member of SGE, The Perth Mint would now also gain access to an extensive network of gold distributors trading directly on the SGE platform throughout China.

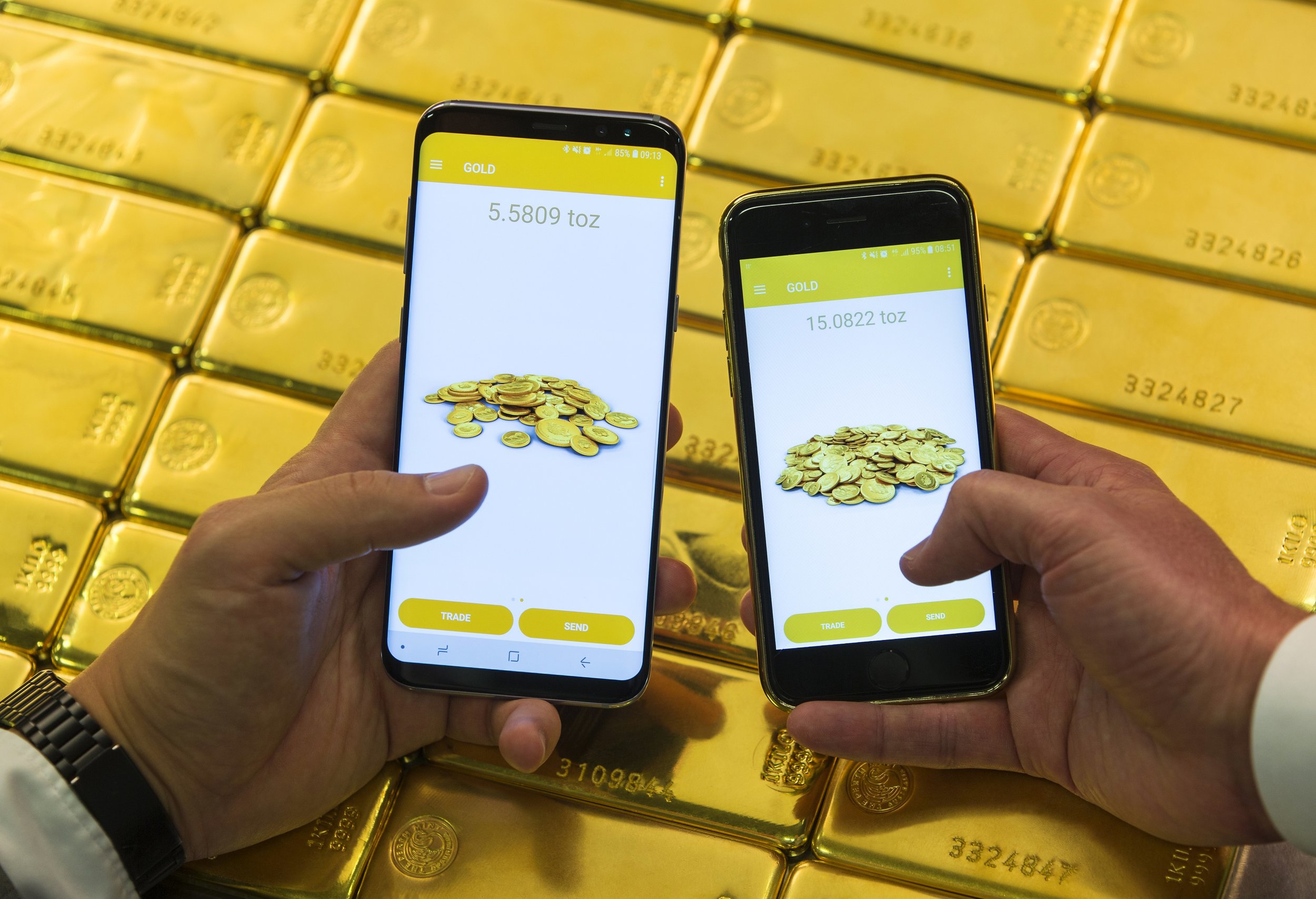

The Perth Mint has launched an exciting new smartphone app – GoldPass™ – during the opening day of Precious Metals Investment Symposium 2018.

At the touch of a smartphone screen, GoldPass™ gives retail investors the unique ability to securely buy, store and sell gold via digital certificates. The app also allows the instantaneous transfer of gold to other approved GoldPass™ app users.

Attracting the who’s who among the globe’s greatest precious metals investors, Western Australia – which accounts for more than 70% of Australia’s overall gold production - has cemented itself as a major destination to explore and mine for the famous yellow metal.

With this in mind, Australia’s largest precious metal event, The Precious Metal Investment Symposium (PMIS), has this year pulled up stumps and relocated from Sydney to WA’s capital and world-renowned mining hub, Perth.

This month marks the 10 year anniversary since Lehman Brothers, one of the highest profile casualties of the Global Financial Crisis (GFC), went bankrupt in the United States.

We spoke to Gold Industry Group Company Secretary Bron Suchecki, who was working at The Perth Mint at the time, and ABC Bullion Chief Economist Jordan Eliseo, about their memories from that time period.

Should central banks hold gold?

From the late 1980s into the new millennium the answer appeared to be in the negative, with global central bank reserves declining from around 36,000 tonnes to under 30,000 tonnes.

The Perth Mint recently launched the Perth Mint Physical Gold ETF (NYSE Arca: AAAU), the first exchange-traded fund with sovereign-backed gold trading on the New York Stock Exchange (NYSE).

AAAU is guaranteed by the Government of Western Australia, with shares exchangeable for delivery of a wide range of gold products.

Presenting to a crowd of 500 West Australian Mining Club members in May, Stuart Tonkin, Chief Executive Officer Northern Star Resources, began by ensuring their view of the gold industry’s future was seen through rose-coloured glasses.

As CEO of one of Australia’s largest gold producers and a Director on the Gold Industry Group Board, Stuart said future proofing the gold sector through investment in exploration was key to staying steady and maintaining current production levels.

ABC Refinery is now officially accredited by the Shanghai Gold Exchange (SGE), making it one of only seven international companies who can sell gold into the world’s top gold consuming nation.

A crucial network for trading gold in China, all official gold sales within China must occur through the SGE making it the primary gateway into the world’s largest gold market worth over A$341 billion annually.

In collaboration with The Perth Mint, InfiniGold has released the latest innovation in gold investment – a flexible digital gold product compatible with a wide range of technology platforms including blockchain.

InfiniGold digital gold certificates offer institutions the opportunity to present investors with a new, secure and easy way to trade, hold and transfer physical gold.

Ask most people that work in finance what they think about Bitcoin, and the likely response will be; “it’s a bubble”.

Google certainly seems to think so too, with “Bitcoin is a Bubble” returning 31,800,000 results, proof of how many times people have, incorrectly so far, called a top in the price of the world’s most famous cryptocurrency.

Given the incredible rally in the price of Bitcoin (BTC), and other crypto-currencies like Etherium this year, there has been no shortage of interest in this space, with precious metal investors asking whether or not BTC is basically a digital version of gold and silver or not.